Google, a ubiquitous force in our daily lives, offers various advertising services, including Google Ads, where understanding features like Google temporary hold on credit cards is crucial.

Why Does Google Place Temporary Holds on Credit Cards?

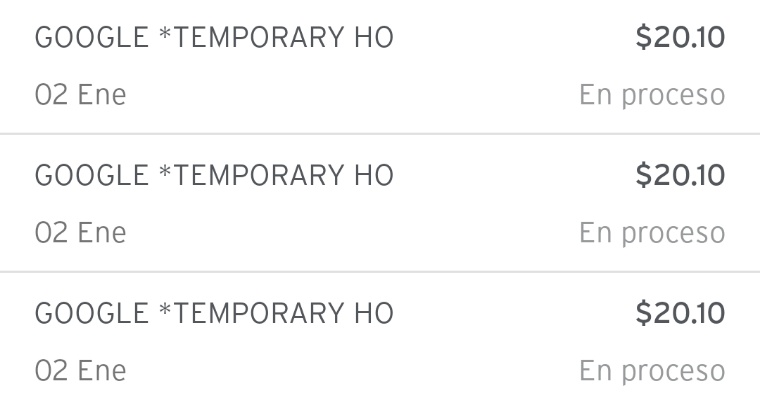

Before diving into solutions, let’s grasp the essence of Google temporary holds. These holds serve as a protective measure implemented by Google to safeguard against potential fraudulent activities. They typically occur during transactions such as making a purchase, activating a trial, or subscribing to promotional offers.

Also read: Google Services Charge

Key Points to Remember:

- Purpose: Verification of payment method validity and availability of sufficient funds.

- Occurrence: Common during various transactions, including purchases and subscriptions.

- Duration: Typically lasting 5-7 days, depending on individual bank policies.

Google implements temporary holds to:

- Verify Card Validity: Ensuring the card is active and valid.

- Confirm Funds: Checking for sufficient funds to cover ad expenses.

- Prevent Fraud: Mitigating risks of fraudulent activities.

- Protect Advertisers: Safeguarding against financial losses.

- Maintain Platform Integrity: Ensuring trust and security.

How Does Google’s Temporary Hold Work?

Google’s temporary hold involves:

- Ad Campaign Setup: Linking an ad campaign to a credit card.

- Pre-Authorization: Verifying card details and fund availability.

- Hold Amount: Reserving a specific amount on the card.

- Impact on Credit Limit: Temporary reduction in available credit.

- Duration: Typically lasting a few days.

- Release: Releasing the hold after the period or campaign cancellation.

What Triggers a Temporary Hold?

Google temporary holds can be triggered by a variety of actions, each with its own set of circumstances. Let’s explore some common scenarios:

| Scenario | Description |

|---|---|

| Making a Purchase | Initiating a transaction, whether for goods or services, can prompt a temporary hold. |

| Activating Trials or Subscriptions | Signing up for trial periods or promotional subscriptions may trigger a temporary hold. |

| Gas Station and Hotel Payments | Certain establishments, like gas stations and hotels, may place temporary holds on funds. |

Understanding these triggers can help contextualize the appearance of a temporary hold on your account.

Implications for Advertisers

Considerations for advertisers include:

- Funds Availability: Temporarily unavailable funds.

- Budget Planning: Factoring in the hold amount.

- Credit Limit Impact: Reduction in available credit.

- Timing Considerations: Duration variability.

- Payment Authorization: Ensuring accuracy of card details.

- Refunds and Cancellations: Delays in hold release.

Tips to Deal with Google’s Temporary Hold

Advisable actions for advertisers:

- Budget Planning: Consider hold amount in budgeting.

- Monitor Transactions: Distinguish between holds and charges.

- Communicate with Issuer: Seek clarification if needed.

- Update Card Information: Ensure accuracy.

- Timing Awareness: Plan campaigns accordingly.

- Stay Organized: Maintain transaction records.

- Refund Preparation: Account for potential delays.

Also read: IRS Code 571

Tips to Prevent Issues

Preventive measures for smooth transactions:

- Verify Card Information: Accuracy is key.

- Monitor Credit: Keep track of available credit.

- Maintain Funds: Ensure sufficient funds.

- Communication: Stay in touch with issuer.

- Budget Realism: Plan budgets realistically.

- Record Keeping: Maintain detailed records.

- Stay Informed: Be updated on policies.

Also read: Jobber Login

Resolving Google Temporary Holds

Encountering a temporary hold can be unsettling, but fret not! Here’s a comprehensive guide to resolving the issue swiftly:

1. Monitor Your Account:

Keep a close eye on your transaction history to track the status of the temporary hold.

2. Contact Your Bank:

If the hold persists beyond 5-7 days, reach out to your bank’s support service for assistance.

3. Clarify with Merchants:

In cases of specific transactions like those at gas stations or hotels, directly contacting the merchant can provide clarity.

4. Top-Up Your Account:

If your account balance is insufficient or negative, consider topping it up to facilitate the release of the hold.

5. Stay Alert for Unauthorized Activities:

Remain vigilant for any signs of unauthorized transactions and take prompt action to secure your account.

Also read: YourRewardCard

Questions and Answers

- What is Google’s temporary hold on credit cards?

- It’s a precautionary measure to ensure card validity and fund availability for Google Ads transactions.

- Why does Google implement temporary holds?

- To verify card authenticity, prevent fraud, and protect advertisers and the platform.

- How long does a temporary hold last?

- Typically a few days, but duration may vary.

- Can advertisers use held funds during the hold period?

- No, held funds are temporarily unavailable for other transactions.

- What happens if there are insufficient funds for the hold?

- The pre-authorization may fail, leading to potential campaign disruptions.

- How can advertisers prevent issues with temporary holds?

- By planning budgets, monitoring transactions, and staying in touch with card issuers.

- Are temporary holds common in the advertising industry?

- Yes, they’re a standard practice to ensure payment authenticity.

- Can advertisers request refunds during the hold period?

- Yes, but they should account for potential delays in hold release.

- What should advertisers do if they encounter payment authorization issues?

- They should verify card details and contact their card issuer for assistance.

- Is updating card information necessary for every transaction?

- Yes, accurate and up-to-date card information is crucial for successful transactions.

Conclusion

Understanding and managing Google’s temporary hold is vital for advertisers. It ensures transaction security and prevents fraudulent activities. By following guidelines and staying informed, advertisers can navigate this process smoothly, maximizing their advertising efforts on Google Ads.

Thank you for exploring this comprehensive guide on Google’s temporary hold on credit cards. We hope it provides valuable insight and assistance to advertisers using Google Ads.