In the realm of retail therapy, few experiences rival the sheer delight of browsing through Ulta’s aisles, brimming with an array of beauty treasures. For the savvy shopper seeking to elevate their beauty game, the Ulta credit card emerges as a potent tool, offering a gateway to exclusive perks and rewards. Let’s delve into the intricacies of this coveted card and unlock the secrets to maximizing its benefits.

Understanding the Ulta Credit Card Landscape

| Credit Card Type | Rewards | Additional Benefits |

|---|---|---|

| Ulta Rewards Credit Card | Earn 2x Rewards Points on all purchases | No annual fee |

| Ultimate Rewards MasterCard | Double points for $1 spent outside Ulta | 500 Welcome Bonus Points for spending $500 in 90 days |

| Ultimate Rewards World Mastercard | Extra point for every $3 spent elsewhere | Low-interest rates |

Advantages of the Ulta Credit Card

- Double Points: Earn twice as many points for every purchase, rewarding you for indulging in your favorite beauty products.

- Welcome Bonus: Spend $500 outside of Ulta Beauty within the first 90 days and receive 500 Welcome Bonus Points.

- No Annual Fee: Enjoy all the benefits of the Ulta Credit Card without worrying about annual fees.

- Extra Rewards: Ulta MasterCard holders earn an additional point for every $3 spent outside of Ulta Beauty.

Two Variants, One Purpose

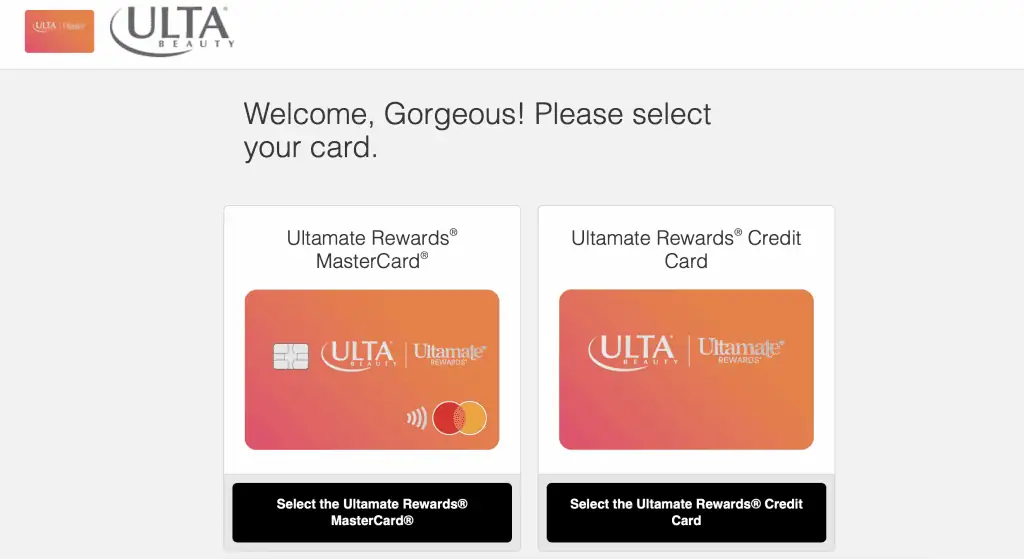

When embarking on the journey to acquire the Ulta credit card, prospective cardholders encounter two distinct offerings tailored to varying credit profiles:

| Credit Card Variant | Key Features |

|---|---|

| Ultamate Rewards Credit Card | Exclusive for in-store and online Ulta Beauty purchases, with no annual fee. |

| Ultamate Rewards Mastercard | Expands usability to any Mastercard-accepting merchant, sans annual fee. |

Synergy with Ultamate Rewards Program

The synergy between the Ulta credit cards and the Ultamate Rewards program amplifies the allure of these cards, propelling shoppers into a realm of enhanced benefits. Here’s a breakdown of the earning potential:

- 2 points per $1 spent at Ulta: Leveraging both Ultamate Rewards membership and credit card perks.

- 1 point per $3 spent elsewhere: Exclusive to the Mastercard variant, extending rewards beyond Ulta’s realm.

Ascending the Rewards Tiers

As shoppers ascend the ranks within Ultamate Rewards, the bounty of rewards grows richer. Here’s a glimpse into the rewards hierarchy:

| Membership Tier | Minimum Spend (per calendar year) | Points Earned (per $1 spent) |

|---|---|---|

| Baseline | $0 | 1 |

| Platinum | $500 | 1.5 |

| Diamond | $1,200 | 2.5 |

How to Apply for an Ulta Credit Card

Ready to embark on your beauty journey with the Ulta Credit Card? Applying is as easy as pie – just follow these simple steps:

- Visit the Ulta Beauty Website or Store: Head to Ulta’s official website to begin the application process.

- Fill Out the Application Form: Provide your personal information, including your name, address, and contact details.

- Employment Information: Share details about your employment status, including your employer’s name and contact information.

- Financial Details: Disclose your income and any other financial information requested on the application form.

- Review Terms and Conditions: Take a moment to review the terms and conditions of the Ulta Credit Card to ensure you’re aware of all the benefits and responsibilities.

- Submit Your Application: Once you’ve completed the form, submit it for review.

- Await Approval: Sit back and relax as you await the approval notification. In most cases, you’ll receive instant approval, making it quick and convenient to start enjoying your Ulta Credit Card perks.

- Receive Your Card: Upon approval, your Ulta Credit Card will be mailed to you within a few business days.

- Activate Your Card: Follow the instructions provided with your card to activate it and start using it for all your beauty needs.

- Enjoy Your Rewards: Once activated, you’re ready to dive into a world of beauty rewards and exclusive offers. Happy shopping!

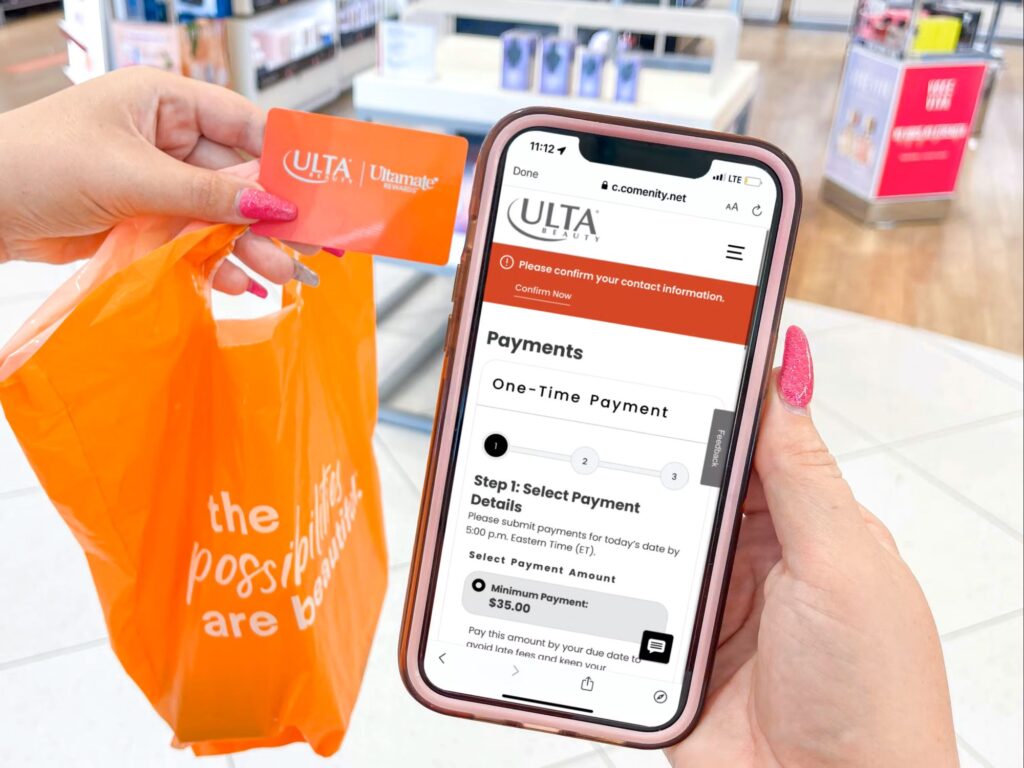

Managing Your Ulta Credit Card Account

Logging In:

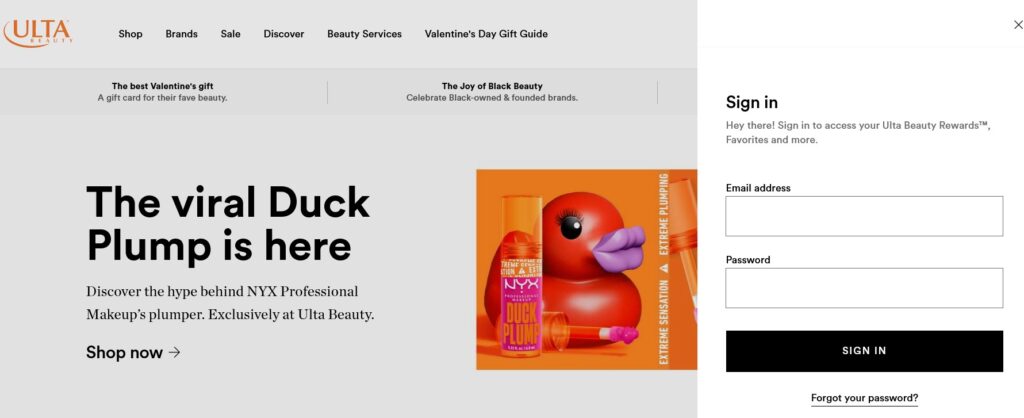

- Launch the Website: Visit the official Ulta website.

- Access Credit Card Portal: Navigate to the credit card login page.

- Choose Your Card: Select either the Ulta Rewards Credit Card or Ulta Rewards MasterCard.

- Sign In: Enter your login credentials and click “Sign In” to access your account.

Activating Your Card:

- Customer Service: Call 1-866-489-3455 or visit the official website for online activation.

- Online Activation: Provide necessary card details on the activation form and follow the prompts to activate your card.

Deciphering Point Valuations and Redemption Dynamics

Elevated Point Values

While the point accrual rates may seem modest at first glance, the true magic unfolds in the realm of redemption. Here’s a peek into the value proposition:

- Points redeemable for a variety of products and services within Ulta’s ecosystem.

- High value per point: Surpassing the industry standard, with redemption values ranging from $0.33 to $0.625 per point.

Mindful of Expiration Policies

While the allure of accumulating points is undeniable, prudent cardholders must navigate the intricacies of expiration policies:

- Points expire after one year for baseline members, incentivizing progression to Platinum or Diamond tiers.

- Low redemption threshold: Starting at just 100 points, ensuring accessibility to rewards.

Unveiling the Beauty of Rewards: A Closer Look

Salon Delights Await

For aficionados of pampering sessions at Ulta’s salon, the Ulta credit card opens doors to a realm of bonus rewards:

- Seamless integration with Ultamate rewards program, extending perks to salon services.

- Potential for substantial savings, with rewards covering a significant portion of annual expenses.

A Cautionary Tale: Beware the Interest Rates

Amidst the allure of rewards, a cautionary note resonates regarding the interest rates associated with the Ulta credit card:

- Ongoing APR: Ranging from 21.99% to 30.99%, contingent on creditworthiness.

- Prudent financial management essential to mitigate the impact of interest accrual.

Accepted Locations for Ulta Credit Card

Your Ulta Credit Card opens doors to a world of beauty possibilities, both in-store and online. Here’s where you can use your card to make your beauty dreams a reality:

| Accepted Locations | Description |

|---|---|

| Ulta Beauty Stores | Shop till you drop at any Ulta Beauty store across the United States. |

| Ulta Beauty Website | Browse and shop online at the Ulta Beauty website from the comfort of your home. |

| Ulta Beauty App | Take your beauty shopping on the go with the Ulta Beauty mobile app, available on iOS and Android. |

| Other Retailers (Mastercard Option) | For traditional credit cardholders, your Ulta Credit Card is accepted wherever Mastercard is. |

Rewards and Discounts with Ulta Credit Card

Your Ulta Credit Card isn’t just a piece of plastic – it’s your ticket to a world of rewards and discounts. Here’s a closer look at the perks that come with being a cardholder:

Ultamate Rewards Program

Bonus Point Promotions

Birthday Gift

Exclusive Discounts

Early Access

Ulta Beauty Catalog and Emails

FAQ: Navigating the Ulta Credit Card Terrain

1. How can I determine which variant of the Ulta credit card is suitable for me?

- Evaluate your creditworthiness and spending habits to ascertain eligibility for the Ultamate Rewards Mastercard.

2. What are the primary benefits of the Ultamate Rewards program?

- Access to exclusive promotions, birthday gifts, and bonus points events, augmenting the allure of the Ulta credit card.

3. Are there any restrictions on redeeming points earned through the Ulta credit card?

- Points can be redeemed exclusively for Ulta products and services, with varying redemption values based on point accumulation.

4. Can the Ulta credit card be used for purchases at Ulta Beauty at Target?

- Purchases made at Ulta Beauty at Target qualify for rewards at the “outside of Ulta Beauty” rate, distinct from in-store Ulta purchases.

5. How can I mitigate the impact of interest charges associated with the Ulta credit card?

- Timely payment of balances and prudent financial management are imperative to minimize interest accrual.

6. Is there a minimum spend requirement to maintain membership within Ultamate Rewards tiers?

- Yes, membership tiers within Ultamate Rewards are contingent on meeting specified minimum spend thresholds.

7. Can points earned through the Ulta credit card be combined with other promotions or discounts?

- Yes, points earned through the Ulta credit card can be utilized in conjunction with other promotions or discounts, enhancing the value proposition for cardholders.

8. Are there any promotional incentives available for new Ulta credit card applicants?

- As of August 2023, the Ultamate Rewards Mastercard offers a modest sign-up bonus for qualifying applicants, enhancing the initial rewards potential.

9. How can I monitor my points balance and redemption options within the Ultamate Rewards program?

- The Ultamate Rewards program offers comprehensive online and mobile platforms for tracking points balance and exploring redemption options, ensuring a seamless experience for cardholders.

10. What measures should I undertake to safeguard against unauthorized usage of my Ulta credit card?

- Implementing robust security measures, such as monitoring account activity and promptly reporting any suspicious transactions, is paramount to safeguarding against unauthorized usage.

Unleash Your Beauty Potential with Ulta Credit Card

With its array of benefits, rewards, and exclusive offers, the Ulta Credit Card is your ultimate companion on your beauty journey. Whether you’re indulging in a shopping spree at your favorite Ulta Beauty store or treating yourself to an online haul, your Ulta Credit Card ensures you’re always rewarded for your love of beauty. So what are you waiting for? Unlock the magic of your Ulta Credit Card today and let your beauty shine!